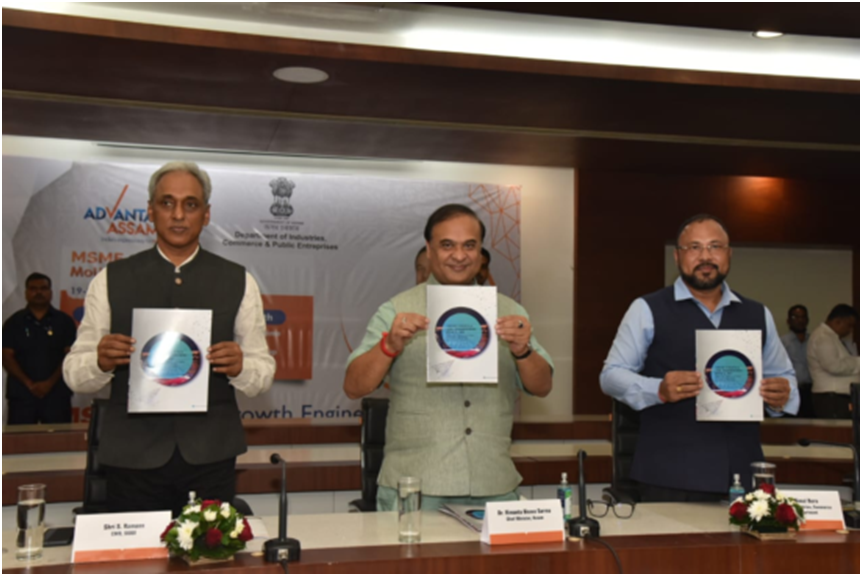

Assam Credit Guarantee Scheme is a joint initiative of the Assam government and Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to provide support to small and medium-sized enterprises (SMEs) in the state. With the help of the scheme, the state government wants to provide collateral-free credit facilities to the SMEs. Assam Credit Guarantee Scheme made effective from April 1, 2023. The existing Member Lending Institutions (MLIS) can take benefit of the scheme.

Assam Credit Guarantee Scheme 2023

This initiative of the state government will promote entrepreneurship and economic growth in the Assam state. It will also help in opening the gates of many employment opportunities. The financial requirement of the MSMEs in the state will also be fulfilled by the Scheme. As per the category of the borrower, the CGTMSE will be giving 75% – 85% of the guarantee coverage for loan facilities. The state government decided to give the balance of 25% – 15% coverage. Last year, the state government signed two MoUs with CGTMSE for the Credit Guarantee Scheme and SIDBI Venture Capital.

Assam Mukhyamantri Sva Niyojan Yojana

Assam Credit Guarantee Scheme Overview

| Name of Article | Assam Credit Guarantee Scheme |

| Introduced By | Government of Assam |

| Beneficiaries | Small and medium-sized enterprises in the state |

| Aim | To support the Small and medium-sized enterprises of the state |

| State | Assam |

| Website | Will be soon released |

Assam Credit Guarantee Scheme Objective

The main purpose of the Assam government to launch this scheme is to provide collateral-free credit to small and medium-sized enterprises (SMEs) in the state. With the help of the scheme, the government wants to boost the growth and development of the MSMEs. It is expected that the scheme will benefit maximum MSEs in the state. Through these efforts, the SMEs will be allowed to avail loans from lending institutions. The main aim is to ensure that businesses in the state have the required funds so that they can fulfill their financial requirements.

Assam Credit Guarantee Scheme Benefits

- It is a major initiative of the state government to promote entrepreneurship and economic growth in the state.

- This Scheme will create employment in the state.

- This plan of association of the state government with CGTMSE will surely help to provide extra guarantee coverage for loans to MSMEs.

- It will also contribute to the overall development of the Assam state.

- This Scheme will support the creation of new enterprises.

- Individuals will be motivated to begin their own businesses.

Eligibility Criteria

- An individual should be from Assam state.

- All Micro and Small Enterprises of Assam can take advantage of the scheme.

- According to the state government, their share of the guarantee will be 15-25% as per the category of borrowers.

- The MSE should have a good track record of financial performance.

Credit Guarantee Scheme Documents

- Domicile Certificate

- Identity Proof

- Loan Documents

- Working Email Id

- The latest Passport Size Photograph of the Owners

- Active Mobile Number

- Enterprise Registration Details

Procedure to Apply for the Assam Credit Guarantee Scheme

The application process and the official website have not yet released as it is a recently announced scheme. You have to wait for some time to know more about the scheme. It is suggested to frequently check the latest updates about the Scheme.

FAQs

This Scheme is a government scheme started with the aim of supporting small and medium-sized enterprises (SMEs) in the state.

This Scheme came into effect on April 1, 2023.